This post may contain affiliate links. Please read our disclosure policy for more information.

Are you desperately trying to save money or look for the best and simple frugal living tips without feeling the need to cut back on the things you enjoy?Perhaps you’ve dug yourself into debt and feel that it’s hard to come out of that deep hole.

Maybe you’re not in debt but you’re living paycheck to paycheck just to cover the basic needs of living.

Don’t feel bad, my friend. You are not alone.

Almost 80% of American workers are living paycheck to paycheck, some with debt and with nothing to show for.

Having been through the cycle of living paycheck to paycheck, I know that saving money is no easy task, and shifting your mindset to frugal living may be a challenge if you’re a beginner.

Frugal living tips for non-cheapskates!

📌 PIN this image so you don’t miss out on the best frugal living tips! 🙂

Don’t worry.

You don’t need any “extreme cheapskate” advice like the ridiculous dumpster diving for free stuff to get out of this rabbit hole.

I feel guilty for saying this but I’m a natural spender and I’ve gone wild over Sephora sales and those BOGO fraps at Starbucks. Admittedly, I’m not the most frugal person.

However, there are many simple frugal living tips and ideas that are easy and effective. You really need to make a conscious effort to make things work if you’re not a frugal person by heart.

These are frugal, not cheap, things I’ve done to help me stop living paycheck to paycheck.

In fact, it’s also helped me build a healthy six-figure savings account within a couple of years.

Of course, finding creative ways to make extra money is just as important! I actually recommend checking out my ideas on how you can make up to $100 in extra money each day.

Without further ado, here are 20+ quality tips on how to live frugally with a big impact on your savings!

Best Frugal Living Tips For Beginners

Today, I’ve put together a list of the best frugal living tips for beginners who don’t know where to start.

Whether you’re living on one income or you’re trying to live more frugally on less so you can pay off your debts, I hope you find these frugal living tips helpful.

1. Find ways to get FREE Amazon gift cards

If you’re devoted to Amazon, enchanted by Sephora, or a Starbucks enthusiast but dread paying the full price, there are numerous ways to secure free gift cards. This can be achieved through online shopping, web browsing, sharing your views on products or services, and engaging in games such as Bejeweled.

Indeed, I’m a fan of cost-saving tools like Survey Junkie, which allow me to earn $50 Amazon gift cards at no cost, ensuring I don’t spend a penny on my online purchases. Survey Junkie stands out as one of the premier survey sites, offering PayPal cash or gift cards simply for expressing your opinions on the products and services you utilize.

GET FREE GIFT CARDS HERE! I recommend signing up for Survey Junkie here for FREE and start earning free gift cards immediately! You could earn as high as $45 per survey!

You can see that so many members give Survey Junkie a positive rating of 4.5/5 stars on Trustpilot reviews. Here is one proof of the many that enjoy using this free saving money resource!

2. Save money each month using Swagbucks

Another saving money tool I couldn’t live without is Swagbucks.com.

With this resource, I literally get FREE money, rewards, and gift cards just by shopping online, watching videos, surfing the web (like what you’re doing now), and answering quick questions on their daily survey polls.

I’ve been using this money-saving weapon for 10 years and I couldn’t thank Swagbucks enough for helping me save money by rewarding me with free e-gift cards to places like Amazon, Walmart, Starbucks, Sephora and much more!

This definitely helps me reduce my spending and it’s always nice to have the option to cash out rewards without putting in a ton of effort. Plus, which frugal person doesn’t like FREE stuff? 🙂

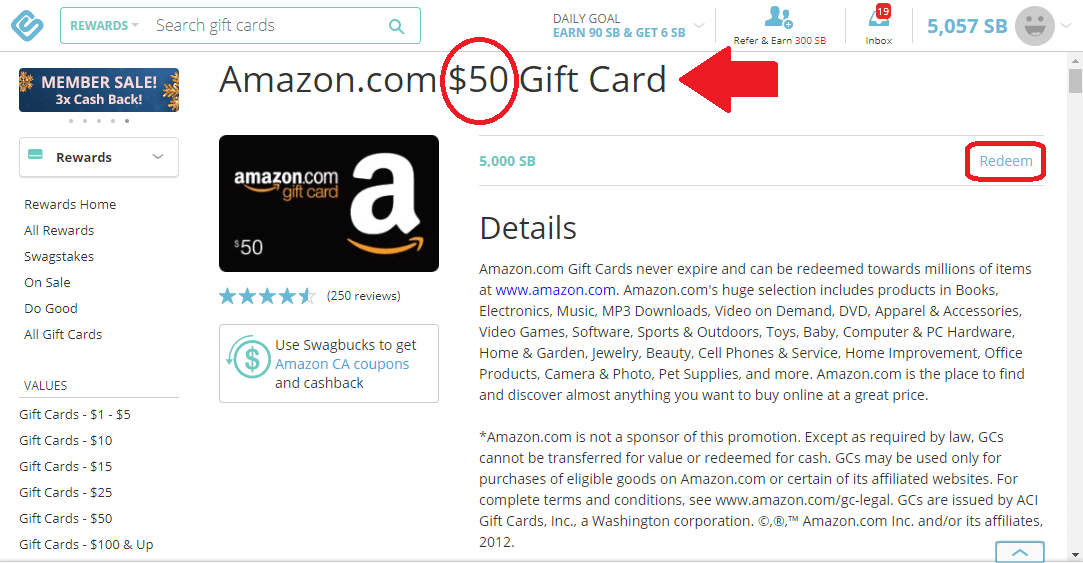

I’m seriously SO excited right now because I can redeem my FREE $50 Amazon gift card online in MY Swagbucks account!

Sign up for Swagbucks here for FREE! You can live frugally and save money by reducing your expenses at stores you normally shop at. You’ll even get a FREE $5 bonus just for joining! You dont want to miss out on free money! It literally takes less than 10 seconds to sign up! 🙂

PRO TIP: Don’t forget to verify the e-mail from Swagbucks in your inbox to get your $5 bonus and you can start earning free gift cards immediately!

Related post on how to save money and live frugally: Earn Free Gift Cards and PayPal Money With These Survey Sites

3. Improve your credit score today

Individuals who are frugal and successful in saving money and accumulating wealth recognize the crucial role of maintaining a strong credit score.

This tip for saving money often goes unnoticed by many because its benefits are not immediately visible. Nor does it offer instant savings like using a $2 coupon might.

Yet, the reality is that an excellent credit score can lead to savings of thousands of dollars—far surpassing what you might save through coupon clipping.

Forbes highlights that maintaining a good credit standing could result in savings up to $80,000.

With a higher credit score, you gain the leverage to negotiate better interest rates, which can lead to significant savings beyond what you might expect.

To enhance your credit score, it’s vital to pay off your credit card balances in full each month and ensure that you never make a late payment on any of your bills.

4. Use money saving apps

Embracing frugal living extends beyond traditional budgeting methods; it also involves leveraging technology to enhance your savings. Money-saving apps have become indispensable tools for those looking to maximize their financial resources.

Apps like Mint provide a comprehensive overview of your finances, enabling better budget management, while Rakuten offers cashback for purchases made through their platform.

For grocery shoppers, Ibotta turns everyday receipts into cash rewards. These apps not only streamline the process of saving money but also transform it into a rewarding experience. By integrating these tools into your daily routine, you can effortlessly boost your savings and advance your financial goals.

5. Buy in-season groceries

When it’s summer, we wear fewer clothes to keep cool. In the wintertime, we bust out our down jackets to stay warm.

If we dress according to seasons then why not eat foods that are in season?

Not only are fruits and veggies fresher when they’re in season, but they’re also cheaper because it’s easier for farmers to grow.

That’s why it’s expensive to eat fruits like watermelon in the wintertime. Plus, if it’s not in season, then it won’t taste as good. No point in buying them out of season when it’s not at its best.

For more tips on how to save money on groceries, check out my healthy grocery list on a budget. These are all the food ingredients you could buy so you can prepare and cook cheap healthy meals without going broke. No dirty food here – all clean eating for a healthy lifestyle within a reasonable budget.

Related post on frugal meals: 15 Cheap Healthy Meals For Under $10 (#5 is surprisingly healthy but costs less than $2 per meal)

6. Stop relying on convenience (unless you can truly afford it)

Convenience is not a bad thing.

In fact, it’s great because it helps us save time which most of us don’t have a lot of.

Just like you, I’m all about efficiency and getting things done fast because time is very precious.

However, relying heavily on convenience ALL THE TIME (when it’s not necessary) could cost you thousands of dollars and make you go broke and depressed in no time!

For example, think about how much you spend on Uber and cabs, takeouts, food deliveries to your home, and not to mention, those unnecessary purchases on Amazon that you forgot about.

Uber may be costing you over $300 each month! 😱

One source from money.com stated that Americans who use ride-sharing apps like Uber spend over $4,000 a year on them.

It’s also not abnormal to hear many stories about those who spend upward of $500 to $700 per month on Uber or Lyft mainly due to the fact these apps are very convenient and tempting to use. One person confessed here:

“I spend over $500 a month because I’m addicted to taxis, Uber and Lyft… and honestly didn’t really notice it adding up until I saw that monthly total in my Mint app and wanted to vomit.” 🤮

PRO TIP: Want to be smart with your money? The cash you save from these convenience traps and unneccesary spending could be parked in a high-yield savings account for an emergecny fund.

In addition to spending on convenience traps like Uber rides, people tend to spend a chunk of their money on food deliveries. Check out this study…

Food delivery charges like UberEats could easily add up each month! 😓

According to research, the top reasons for spending an absurd amount of $100 per month on deliveries are:

- Cravings (44%)

- Being too lazy (37%)

- Not having time to cook (26%)

If you only consider these two convenience traps (e.g. just Uber rides and food deliveries alone… NOT including other expenses like Amazon, shopping, entertainment, or dining out), that can easily add up to over $5,000 a year in spending!

You may want to think about how hard you’ve worked for your money. Every individual is different and we all have different values, so ask yourself whether this type of convenience justifies the cost.

If you can truly afford the convenience, then definitely go for it!

On the other hand, if you cannot afford it without sacrificing your savings, then you may want to consider giving yourself a budget and limiting these expenses to a reasonable amount so you can build an emergency fund or invest your money.

SOLUTION: If you want to save thousands of dollars on food, then consider joining this $5 Meal Plan. For only $5 a month, they will send you delicious and healthy weekly meal plans straight to your inbox helping you save time and money on food.

Each meal works out to be $2 per person. They even have gluten-free options available! Once I started meal planning at home, my family saved over $5,000 each year!

You could even get a FREE 14-day risk-free trial when you join here. They are serious about customer satisfaction, so for any reason if meal planning is not right for you, then cancel anytime with absolutely NO questions asked. 🙂

7. Buy fruits and veggies in bulk and freeze them for smoothies

Are you using your freezer to its fullest potential?

Or a better question is are you spending over $6 to $10 on those freshly squeezed juices almost every day?

As long as you have enough storage space, you’re on your way to saving money!

When it comes close to the end of summer, it’s a smart idea to stock up on fruits and vegetables and freeze them for later.

According to USDA, you can store frozen fruits and vegetables for a year. That leaves you with a good amount of time to enjoy them!

Alternatively, you can buy packaged frozen fruits and vegetables for convenience.

Either way, they’re perfect for making morning smoothies or fruit drinks with THIS affordable personal blender to kick-start your day! For smoothies, add a fresh banana to it for more thickness!

This is a great way to help you stay healthy and save money while being able to enjoy those delicious mouth-watering smoothies!

8. Buy meat in bulk and freeze them

Do you love meat?

Just like freezing fruits and veggies, you can do the same with meat.

When there’s a good sale, you can buy in bulk and freeze them for next time.

Don’t overbuy them though just for the sake of “saving” money. Make sure you will have enough time to consume them so it doesn’t end up in the dumpster.

USDA recommends the following when storing raw meat:

| Item | Months |

| Bacon and Sausage | 1 to 2 |

| Casseroles | 2 to 3 |

| Egg whites or egg substitutes | 12 |

| Frozen Dinners and Entrees | 3 to 4 |

| Gravy, meat or poultry | 2 to 3 |

| Ham, Hotdogs and Lunchmeats | 1 to 2 |

| Meat, uncooked roasts | 4 to 12 |

| Meat, uncooked steaks or chops | 4 to 12 |

| Meat, uncooked ground | 3 to 4 |

| Meat, cooked | 2 to 3 |

| Poultry, uncooked whole | 12 |

| Poultry, uncooked parts | 9 |

| Poultry, uncooked giblets | 3 to 4 |

| Poultry, cooked | 4 |

| Soups and Stews | 2 to 3 |

| Wild game, uncooked | 8 to 12 |

PRO TIP: Write down the expiration date on a Ziploc freezer bag like THIS particular one before storing the meat away into your freezer. You will avoid wasting good food, or even worse, eating food past its expiration date.

9. Invest in the Instant Pot to make fast meals for less

As mentioned in the last point, many people just don’t have the time or patience to cook a nice homemade meal.

Trust me, I do feel your pain.

After a long day of work, you’re tired and just don’t want to think about what to eat.

What most of us end up doing is ordering takeout or grabbing a drink with our coworkers which isn’t just costly, but it’s unhealthy as well.

What’s new?

I know you don’t need to be told that you can save a crapload of money just by skipping the takeout and healthy meals.

You know that already.

You just want to know HOW you can ditch eating out all the darn time.

Simple — THIS simple-to-use Instant Pot was created for people like you who don’t have time to cook at home.

If you haven’t tried it yet, then you’re seriously missing out!

I never thought I’d be able to save money on food because I’m just that bad of a cook. But the Instant Pot makes preparing a meal so easy. It’s no wonder why people rave about it so much!

You can ditch your slow cooker, pressure cooker, rice cooker, and sauté pan because the Instant Pot can do all of that!

I use the Instant Pot at least 3 times a week and I’m able to make quick meals in just 30 to 40 minutes without having to watch over it.

Do a quick Google search online and you’ll find a long list of frugal living recipes that can easily be prepared in less than 30 minutes.

10. Earn cashback on your online shopping

Savvy shoppers like you are skilled at hunting for deals when they’re shopping online.

For me, I love looking for the best ways to save money on beauty products and just about everything I buy!

One of my favorite ways to save money when shopping is to use free cashback resources like Rakuten (formerly Ebates).

If you don’t know what these free cashback resources are, then you’re seriously missing out!

You literally get free money just by shopping for the things you were going to buy online.

It’s so darn easy to save money and get cashback with Rakuten – it’s my go-to resource every time I hit the checkout button.

EARN FREE MONEY TODAY: Create a free Rakuten account here today and get a $10 bonus immediately after making your first $25 purchase online!

How does Rakuten work?

Most people are skeptical and think it’s too good to be true but once you understand how it works, then it makes a lot of sense.

They are partnered up with over 2,500 stores and will earn a commission from those retailers when you shop through Rakuten.com.

Instead of pocketing 100% of the commission themselves, Rakuten will share that commission with you.

The default cashback is between 1-3%, but when there are promotions, you can usually get 15% off your Amazon purchases! Sometimes as high as 40% for certain retailers.

11. Save money and get cashback on your groceries

If you stop by the local grocery store, or if you’re on your way to do some regular shopping, then you shouldn’t miss out on using Ibotta.

Ibotta is one of the best and most popular money-saving apps out there today.

Did I mention it’s absolutely free to use too?

This savings app gives you cashback on the things you buy. That includes groceries and restaurants.

Aside from instant rebates you get from purchasing food products, Ibotta is partnered up with major retailers to offer discounts and cashback to everyday shoppers like you.

It’s quick and simple to earn cashback on your regular weekly grocery shopping – all you have to do is take a photo of the receipt with the app.

GET CASH BACK HERE: Ibotta has paid out over $526,418,586 to app users and this number is growing every 5 seconds!

You can check it out yourself by downloading the Ibotta app here for FREE! You’ll even get a $10 bonus just for trying it. Be sure to check out the cashback deals you get from places love like Walgreens, Walmart, Amazon, Sam’s Club and more!

12. Shop early to get great deals

Are you a last-minute person?

Change your habit and avoid shopping close to or on the day of the event.

For example, you don’t want to find yourself hunting for the perfect gift for your mom on her birthday. You certainly don’t want to leave all your Christmas shopping until Christmas Eve!

This can become overwhelming and stressful which may lead you to make decisions based on impulse. In turn, you may end up spending more than you had originally planned.

Avoid all that unnecessary stress and save some money by planning your holiday shopping a couple of months ahead.

The best part is that stores often have good sales during long weekends so you don’t have to wait for Black Friday to score a deal.

Another benefit of shopping early is you can avoid the crazy line ups, angry shoppers, shipping delays, and the risk of items being out of stock.

13. Clear your cookies to get the best price

No, I’m not talking about the cookies in your cookie jar.

When you go online to search for things, read an article, or purchase something, you leave a trail of your online browsing behavior. Your Internet browser tracks your data in the form of what is called “cookies.”

Cookies are sweet but not when it comes to shopping online.

They make your life easier because it remembers your login information, password, or the tracking items in your online shopping carts.

Without cookies, you would have to type in your user name and password every time you want to log into your email.

On the flip side, some online stores use cookies to charge different prices to different customers.

For example, if a retailer knows that you’ve been consistently visiting their online shop, they know that you’re an interested customer and are more likely to pay more for their products than a brand new customer.

Some online retailers may not want to give better discounts to returning customers.

With that said, avoid getting ripped off by online retailers by always clearing your browser cookies before you add items to your shopping cart.

14. Get rid of clutter and junk to avoid overbuying

Are you sick and tired of overspending your money on unnecessary things that eventually turn into clutter?

Sure, it’s a beautiful mess and you know exactly where everything is located most of the time.

But clutter tends to overwhelm people and it puts unnecessary stress on your health – mentally and physically, relationships and finances!

When your home is not organized, it’s easy to misplace things and forget where you put them. This may cause us to buy things over and over again because we either forgot where we stored it, or we forgot that we purchased an extra spare in our last Amazon shopping spree.

If you’re not a paperless person, you may even miss the payment dates on your bills and end up paying a late fee because you accidentally mixed your bills with the junk mail.

There goes money down the drain!

To avoid spending or wasting money, spend some time to organize your life starting with your home and your stash of mail and bills.

15. Organize your home with these DIY dollar store hacks

We understand that clearing your clutter and junk is a major challenge.

That’s why we’ve put together a list of these creative DIY dollar store organization hacks to help you figure that out!

These are all very affordable projects (for just dollars) that can help you organize your home for better living. They’re also budget-friendly alternatives compared to the real products that cost a lot more!

Try tackling one of these fun projects over the weekend. 🙂

16. Sell your clutter and junk for extra money

While I enjoy giving tips on ways to save money, I also love talking about ways to make extra money!

Continuing our conversation about clearing clutter, you have the choice to donate or sell your junk for extra cash.

If you have the opportunity to earn extra money this weekend, take advantage of it.

I recommend using this free Decluttr app to sell your stuff online for quick money.

Alternatively, you can host a garage sale on a weekend. One of my neighbors just made over $1,000 in one day from clearing out their junk. Remember that one man’s trash is another man’s treasure!

Overall, you don’t need to become a minimalist and live next to nothing.

But the takeaway is to keep things that you need, use, and are important. Your life will be a lot simpler.

You’ll also be surprised at how much money you have in your bank account.

Trust me on this one.

17. Tackle on some light DIY projects

It’s important to bring your car to your local car dealership or shop for regular maintenance. Safety is number one!

But this can add up fast if you constantly bring it back every time for a minor problem.

Before calling up the car body shop, first, ask yourself if you can do simple tasks. That includes changing a headlight bulb or windshield wiper.

You can find a ton of information online include YouTube videos done by pros who show you step-by-step instructions on how to implement those changes.

Not handy at all?

Call a good friend up and tackle it together as a team.

For complicated or big jobs, make sure you hire a professional to take care of the jobs. The last thing you want is to poke around and make matter worse.

18. Take proper care of your clothes

I was always told to always wash my clothes after one wear. It’s something I used to do all the time because I thought it was just being “clean”.

But I realized I wasn’t caring for my garments as much as I should’ve. I also eventually learned that certain clothes don’t need to be washed after every wear, which we will go over in a bit.

If your favorite pair of jeans is still clean with no stains, dirt or odor after a single wear, you can wear them a few more times before tossing them into the washer.

I’m also assuming you’re careful with your clothes and not always playing in the mud with your kids.

Skipping the weekly wash cycle will extend the life of your outfits and lower your laundry cost. It’s a win-win!

According to Real Simple’s guide, these laundry tips will help you save time and money.

T-shirts and tanks – after every wear

Anything white or silk – after every wear

Underwear and socks – after every wear

Workout clothes – after every wear

Shorts – after 2 to 3 wears

Sweaters (cotton, silk & cashmere) – after 2 wears

Sweaters (wool and synthetic blends) – after 5 wears

Pajamas – after 3 to 4 wears

Jeans – after 4 to 5 wears

Dress pants and skirts – after 5 to 7 wears

19. Always negotiate for more pay!

So many people settle for things in life.

They will come up with excuses and avoid negotiating for a better salary, hours and prices because the negotiation process makes us uncomfortable.

I get it because we like comfort.

We don’t generally negotiate because we’re afraid of being rejected. Another reason we avoid negotiating is because we are afraid of being viewed as pushy, greedy, or even cheap.

If you don’t ask, the answer will always be “no” and things will be status-quo.

But if you ask, you may get a “yes” and your bank account will become happier.

Earning more money is no easy task, but it can definitely improve your living standards if you’re willing to go the extra mile to ask for more.

So no, asking for more money is not being greedy.

Missing out on this money may hurt you financially in the long run.

When companies calculate your bonus and salary/wage increases, it’s typically based off your base salary.

One mistake I made is not fighting for a higher starting base salary. If you don’t negotiate for a higher base salary, your raises and bonus will be lower.

20. Negotiate for monthly savings!

In addition to negotiating for a higher salary, you can save a lot of money by negotiating better deals with your monthly services.

That includes cellphone, cable, insurance, and other monthly services you pay for.

No, this is not cheap. It’s being a smart and savvy shopper.

Again, if you’re not much of the negotiator, you can learn more about Trim and how this FREE service can help you negotiate your monthly bills to save money. It’s absolutely FREE to sign up for and use!

Companies are willing to pass down the savings to you (as long as what you’re asking for is reasonable) because you are supporting their business by being a loyal customer.

But before you negotiate, spend the time to do some research. It helps to know about current promotions so you have a better chance of scoring a good deal.

Being knowledgeable helps a lot in the negotiation game!

21. Enjoy free outdoor activities

Is it just me or do you feel sluggish and tired because of the countless hours spent at your day jobs?

For most of us, that’s at least 8 hours a day in front of our computers!

During work hours, we’re busy typing away at our desks answering endless emails. At home, we’re like couch potatoes with our smartphones ready to check our social media feeds and catch up on juicy things we’ve missed.

With that said, most of our time is spent inside the home and not enough outside.

We don’t need scientific research to tell us that outdoor activities provide many health benefits and can improve our overall well-being.

Go ahead and get some fresh air. Embrace nature and these outdoor activities for free!

Have a picnic at the park

If you like to relax and eat at the same time then going for a picnic is perfect for you. Going on a picnic with your friends and family is a great way to spend quality time together. Being around green sceneries is therapeutic and will make you feel calmer and less stressed.

Go for a hike

One of the best ways to get back in touch with Mother Nature is hiking. You can disconnect and escape all the negative distractions coming from your electronics to recharge your mind and body. You’ll feel refreshed and full of energy after a good hike. Be sure to wear proper shoes and stay hydrated.

Go to the beach

When you think of summer, you think of the nice sandy beaches. Save the plane ticket to Florida and head over to your local beach! Go for ice cream, a stroll in the park, swim with your friends or bake in the sun! Be sure to protect yourself with sunscreen and remember to stay hydrated at all times.

Hit up your local festivals

Think your city is boring with nothing to do?

Think again.

There are many fun things happening in your city but you tune it out because you’re either take your city for granted or because it’s outside your comfort zone. Do a simple Google search on what to do in your city and you’ll be surprised by the results. Trust me, if your city were truly boring with nothing to do, there wouldn’t be any tourists visiting it.

22. Check out your local library

Not to sound like a broken record but this is legitimate advice.

When I first searched for frugal living tips online, I wasn’t really open to this idea either. It wasn’t until I actually dropped by my local library, I realized how much free stuff I was missing out on!

Although the library is the place to be if you love reading or studying, it’s not just for bookworms. This place is a treasure chest filled with free resources for you to discover.

You can dive into your favorite magazines or comic books there without having to pay for those costly subscriptions!

Some libraries even offer free summer activities for you and your kids! These activities include building lego, playing bingo, watching movies, and much more. Visit your local library for more details.

23. Plan a potluck

Do you know your favorite restaurants’ menus by heart?

Ah, it’s a sign that you may be spending a lot of money eating out.

It’s totally fine to dine out at your favorite restaurants with your friends but if this turns into a habit (and you can’t truly afford it), you’ll be eating away your fortune in no time.

Instead of spending too much money on restaurants and takeouts, try hosting potlucks and gatherings with your friends every week to save money.

There are SO many amazing recipes that you can bring to your potluck. All you have to do is search for them on the Internet.

A good idea is to discuss what each person will be making and bringing to avoid a table full of the same food.

Potlucks will save you from the overpriced meals, terrible services and mandatory tip culture at restaurants.

24. Go for a drink or dessert

If you love going out and you can’t stand staying at home, you can always arrange a night out at your local café or dessert place.

The most important part is spending time with your friends and chit-chatting away to catch up. If you can, make an attempt to save money by meeting up with your buddies after dinner.

Spending money on appetizers, drinks or a dessert is a lot less than a full course meal at the restaurant.

Alternatively, you could also go out for lunch instead of dinner to save money. You get my point. 🙂

What is frugal living?

Is it just me, or when you hear the term “frugal”, you cringe, sigh, laugh, cry, etc.?

It’s no surprise why most people don’t like the word, “frugal”.

They associate frugal living with the following:

- Cheap

- No spend

- Penny-pinching

- Depriving yourself

- Living under the rock

- Tacky and low quality

- Limited mindset

- Scarcity

You get the idea, right?

After researching extensively about this topic, frugal is NOT the same as being “cheap”.

Frugal living is being smart and resourceful with your money. It’s all about living intentionally and not wasting money on things that don’t add value to your life.

That also means NOT going for the cheapest price at the expense of quality or something you truly value. Only cheap people do this.

Frugal people are savvy shoppers and they go for the best value.

This means prioritizing needs and wants that still allows you to enjoy life. Without sacrificing the things you really love.

Don’t be afraid to spend money on quality things that actually last.

A cheap person doesn’t like to spend money and will buy the lowest-priced item. They will sacrifice quality for price any day.

For example, a cheap landlord would rather buy the cheapest light fixture for their tenant, which may not last long, than to invest in a more one a quality one that lasts longer.

What’s worse is a cheap person may even free-load off their friends and families just to avoid paying for things!

A frugal person would not do any of this.

Do you see the difference?

How do you live frugally?

Now that we have a clear understanding of what frugal living is, we can now practice frugality to reap the financial benefits.

Aside from saving money, living frugally has many other benefits.

Here are the positives of adopting a frugal lifestyle and living intentionally.

Here’s what frugal living is like. You may:

1. Stress less – you won’t feel like you need to maintain a “high-life” profile just to live for others.

2. Have less clutter – when you stop buying unnecessary things you won’t have a house full of clutter which leads to mental stress.

3. Gain more freedom – saving and investing money into your retirement fund will allow you to buy “more freedom” instead of “stuff” that doesn’t make you happy.

However, if you’re not careful between “spending” vs. “saving”, you may cross the line of frugality and end up in the cheapskates’ territory.

No, don’t go there, girlfriend!

When you hoard every penny, it can become exhausting and may lead you back into the “spending-too-much” territory.

Your time is valuable and it’s something you can’t buy back so don’t wait in line for hours at the cheapest gas station just to save a few bucks.

Similar to dieting, if you try to restrain yourself from the foods you love, you may just end up losing motivation. As a result, you just go back to eating all that junk.

With that said, it’s important to balance between “spending” vs. “saving” and avoid each extreme spectrum. This is the hardest part but with practice and patience, you’ll be on your way to living a frugal lifestyle without giving up on the things you love.

How can I live more frugal?

Does it make you sigh when you look at your draining bank account?

You’re probably wondering why your savings aren’t growing over the years despite your increase in take-home pay.

The answer is simple.

You may be a victim of lifestyle inflation.

You may be living with lifestyle inflation when your expenses rise along with your salary.

It’s so common for most people to suddenly increase their spending once they get a job promotion. They’ve naturally (and sometimes unknowingly) upgraded their lifestyle by being looser with their money.

They start to go out more often or spend more money on random things they think would make them happy. These “nice-to-have” things slowly turn into what they call necessities.

The good thing is that living frugally can reverse this trend and allow you to take control of your finances.

Final thoughts about frugal living tips

Again, living a frugal lifestyle doesn’t mean you can’t spend or treat yourself to something nice after a job promotion or career switch. It’s important to celebrate your wins in life so go ahead and reward yourself!

However, don’t splurge on things for the sake of spending. And definitely don’t spend on things that will make you happy for a week only, like upgrading your car to the newest model when your current one works perfectly fine.

Instead, spend intentionally and buy things that really matter to you!

So, go ahead and book a plane ticket to Hawaii with your buddies that you had put on hold for a long time. A memorable trip with the people you care about beats a new shiny object any day!

Readers, are you ready to embrace frugality and live your best life to save money? What are your frugal living tips for beginners? Give us your best frugal living ideas by leaving your comment below!

Leave a Reply